Reviewing Whether Afterpay Use Can Influence Your Credit History Score

As the popularity of Afterpay proceeds to climb, lots of individuals are left wondering concerning the possible effect this service might carry their credit score scores. The correlation in between Afterpay usage and credit report scores is a subject of rate of interest for those aiming to keep or enhance their financial wellness. By checking out the nuances of how Afterpay purchases are checked out in the eyes of credit report bureaus, we can begin to untangle the complexities of this modern repayment method's impact on one's creditworthiness. Allow's look into the complexities of this partnership and discover the vital aspects at play.

Understanding Afterpay's Impact on Credit history Ratings

The utilization of Afterpay can influence individuals' credit rating, motivating a requirement for an in-depth understanding of its influence. Afterpay, a preferred "get currently, pay later on" solution, allows consumers to divide their acquisitions into smaller sized installation repayments. While Afterpay does not do credit checks when consumers originally register, late or missed out on settlements can still affect credit rating. When a consumer misses out on a repayment, Afterpay might report this to credit score bureaus, leading to an adverse mark on the person's credit history report. It is crucial for customers to comprehend that while Afterpay itself does not naturally harm credit rating, careless usage can have repercussions. Keeping track of payment due dates, preserving a good settlement background, and ensuring all installations are paid in a timely manner are essential steps in protecting one's credit rating when making use of Afterpay. By comprehending these nuances, individuals can leverage Afterpay sensibly while minimizing any type of potential negative results on their credit history.

Factors That Impact Credit Report Modifications

Understanding Afterpay's influence on credit ratings discloses a straight link to the numerous elements that can substantially affect changes in an individual's credit rating score over time. Making use of Afterpay properly without maxing out the available credit history can aid preserve a healthy debt application ratio. Additionally, new credit scores queries and the mix of credit score accounts can affect credit report scores.

Monitoring Credit History Modifications With Afterpay

Keeping track of credit history score modifications with Afterpay involves tracking the impact of settlement behaviors and credit rating use on overall credit scores health and wellness. Using Afterpay for little, convenient purchases and maintaining credit card equilibriums reduced family member to credit history limits demonstrates accountable debt behavior and can positively influence debt ratings. By remaining proactive and watchful in keeping an eye on settlement behaviors and credit history application, people can properly handle their credit report score while utilizing Afterpay as a payment alternative.

Tips to Manage Afterpay Sensibly

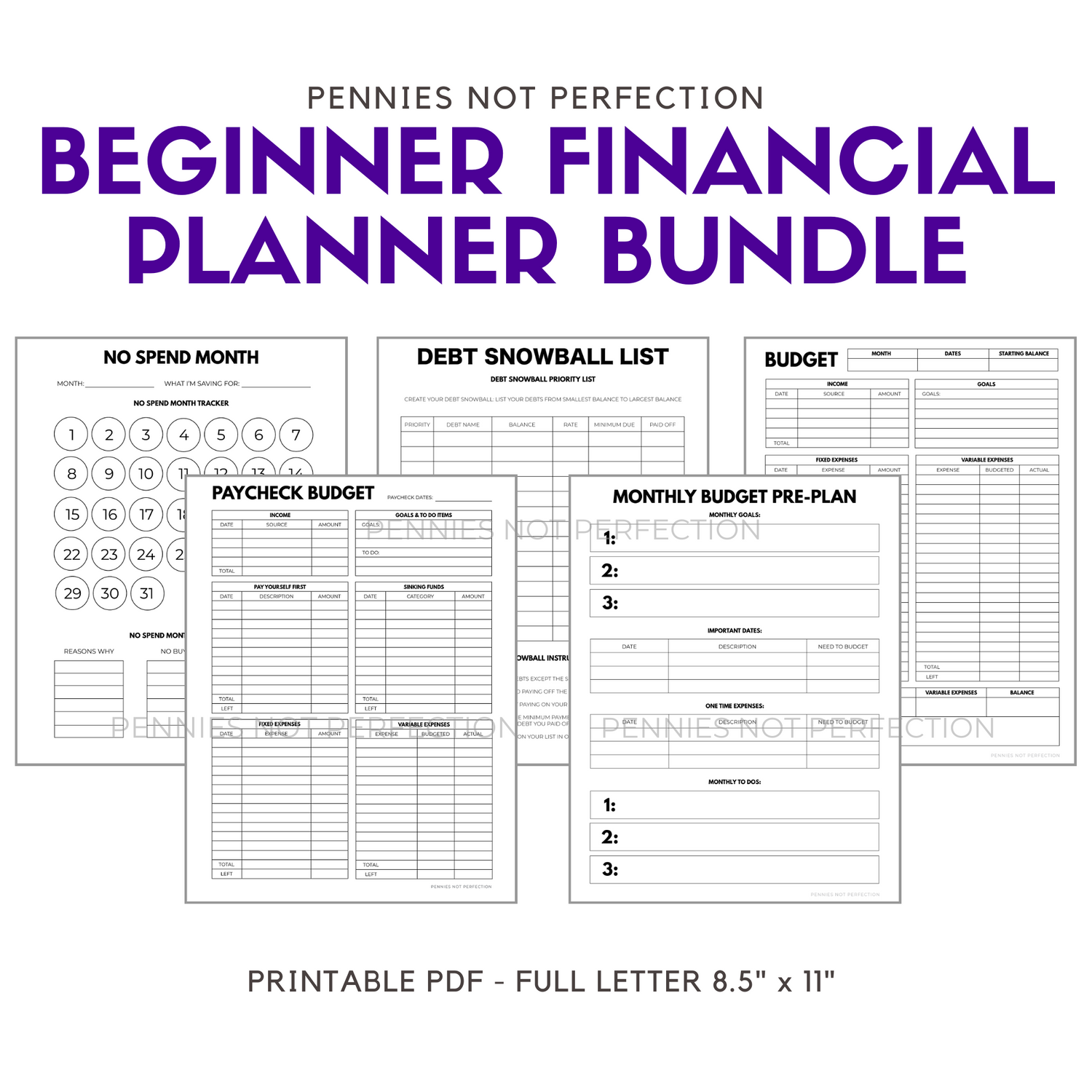

To navigate Afterpay sensibly and preserve a healthy and balanced credit rating, individuals can apply reliable methods to handle their monetary obligations wisely. First of all, it is essential to develop a budget detailing earnings and expenditures to guarantee price before committing to Afterpay purchases. This method aids stop overspending and building up explanation debt beyond one's methods. Second of all, utilizing Afterpay uniquely for crucial things as opposed to indulgent purchases can assist in preserving monetary security. Focusing on repayments for requirements can avoid unnecessary monetary stress and promote responsible costs habits. In addition, keeping track of Afterpay repayment routines and making sure timely payments can aid prevent late costs and negative influence on credit rating ratings. On a regular basis keeping track of Afterpay transactions and general financial health and wellness through budgeting applications or spread sheets can offer useful understandings right into spending patterns and help in making informed financial decisions. By adhering to these suggestions, people can leverage Afterpay properly while safeguarding their credit rating and economic well-being.

Conclusion: Afterpay's Role in Credit score Health

In evaluating Afterpay's effect on debt health, it becomes evident that prudent financial management stays vital for individuals utilizing this service. While Afterpay itself does not directly affect credit rating, neglecting repayments can bring about late costs and financial obligation build-up, which might indirectly affect creditworthiness - does afterpay affect credit score. It is important for Afterpay individuals to budget plan efficiently and guarantee timely settlements to promote a favorable credit score standing

In addition, recognizing exactly how Afterpay integrates with personal money routines is vital. By utilizing Afterpay responsibly, people look at this site can appreciate the comfort of staggered payments without jeopardizing their credit wellness. Checking costs, evaluating price, and remaining within spending plan are fundamental techniques to protect against monetary stress and possible credit report implications.

Verdict

Comprehending Afterpay's click for more info influence on credit scores reveals a straight web link to the various elements that can considerably affect modifications in a person's debt rating over time. In addition, brand-new credit rating queries and the mix of credit report accounts can influence credit score scores.Monitoring credit rating rating modifications with Afterpay entails tracking the impact of settlement practices and credit usage on overall credit score health and wellness - does afterpay affect credit score. Utilizing Afterpay for little, manageable purchases and maintaining debt card equilibriums low relative to credit scores limits shows accountable credit history behavior and can favorably influence credit history scores. By remaining alert and aggressive in monitoring repayment practices and credit application, people can successfully handle their credit score while using Afterpay as a repayment choice